Zcash has experienced a remarkable surge in recent weeks, driven by an increased demand for privacy coins across the cryptocurrency market. Its rise particularly stands out due to ZEC’s limited correlation with Bitcoin (BTC), allowing it to perform independently during times of volatility, which has fueled renewed interest and strengthened its upward momentum.

Zcash Is Independent

The current correlation between Zcash and Bitcoin is at a notable -0.78, indicating a strong negative relationship. This statistic means ZEC often moves in the opposite direction of BTC, a significant benefit especially as Bitcoin hovers around $90,000 after experiencing several days of decline. ZEC’s ability to decouple from BTC allows it to sidestep broader market pullbacks, providing a sense of stability during turbulent times.

Sponsored

This negative correlation has persisted since early November, reinforcing ZEC’s resilience in the market. As long as this correlation remains below zero, Zcash will be less susceptible to sell-offs driven by Bitcoin’s fluctuations.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

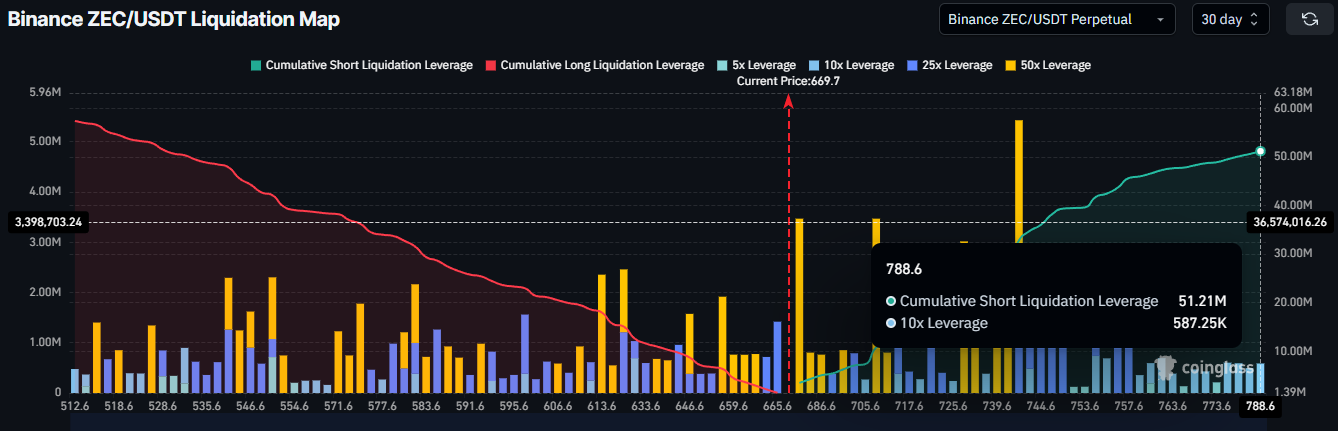

Macro indicators also suggest favorable conditions. According to Zcash’s liquidation map, short sellers should approach the market with caution. If ZEC rises to $788, approximately $51 million worth of short positions could face liquidation. This scenario serves as an additional deterrent for traders considering bearish strategies.

Large liquidation clusters often discourage entering short positions and can catalyze further upside as forced liquidations amplify price movements. For ZEC, achieving these liquidation levels could disrupt bearish sentiment and offer additional support for its continued appreciation.

ZEC Price Has A Lot Of Room To Grow

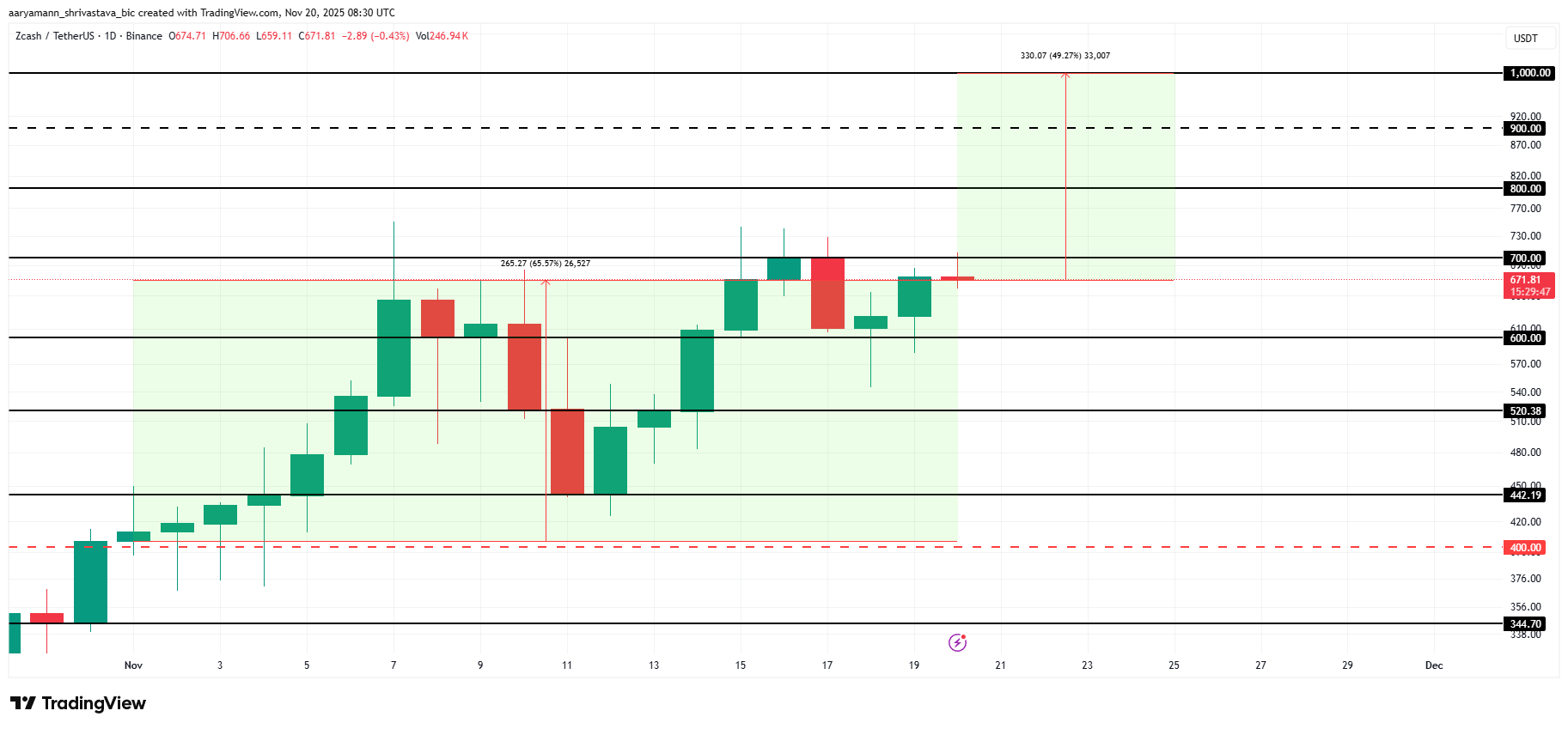

Zcash is currently trading at $671, just below the crucial $700 resistance level. The altcoin has seen a 65.5% increase since the beginning of the month, indicative of strong market interest from both retail and institutional traders alike.

If the current momentum continues, ZEC could target $1,000, which is 49% above its current price point. Achieving this ambitious target could be feasible within the next ten days, provided investor support remains robust. For ZEC to breach the $1,000 mark, it needs to convert the $700, $800, and $900 levels into new support.

However, it’s crucial to remain mindful of potential selling pressure. Should it increase significantly, ZEC might lose momentum and could drop to around $600. A deeper correction could even push the price as low as $520, invalidating the current bullish outlook and leaving the asset vulnerable to a potential crash.