Speculation is beginning to stir once again over whether leading altcoin Ethereum could finally test the long-awaited $5,000 milestone.

This renewed optimism comes as on-chain data confirms that the crypto market has officially entered altcoin season — a phase historically characterized by altcoins outperforming Bitcoin (BTC). Despite the broader market grappling with bearish sentiment in recent days, which has impacted ETH’s price action, underlying indicators show resilience among coin holders. This situation might create a fertile ground for an extended rally toward the coveted $5,000 mark. Here’s how that might unfold.

80% of Top Altcoins Outperform Bitcoin—Is ETH Next to Rally?

According to Blockchain Center, an altcoin season commences when at least 75% of the top 50 altcoins outperform BTC over a three-month period. Recent data from an on-chain analytics platform reveals that a striking 80% of these tokens have surpassed BTC’s performance within the past 90 days, comfortably exceeding the requisite threshold. This marks an official indication that we have entered altcoin season.

With market focus shifting from Bitcoin toward altcoins, Ethereum stands poised to capitalize on this trend. The question now is whether this shift in attention could catalyze a rally towards the much-anticipated $5,000 milestone for the altcoin.

ETH Holder Conviction and Institutional Demand Fuel $5,000 Buzz

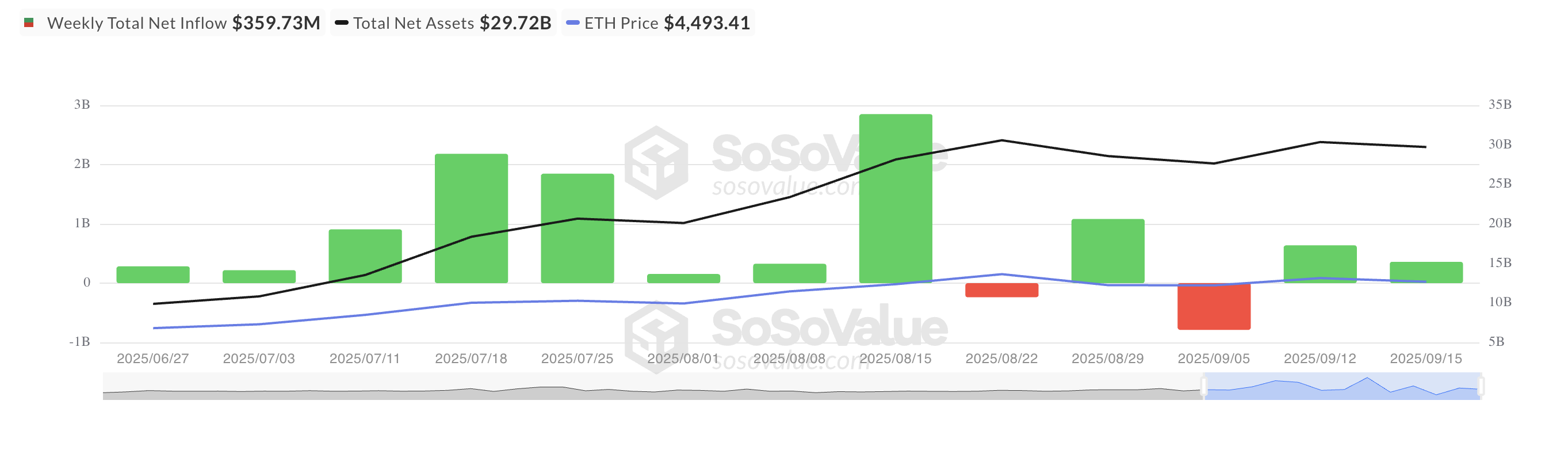

One of the strongest indicators that Ethereum may successfully approach this price point is the noticeable increase in institutional inflows. Recent data from SosoValue reveals that Ethereum ETFs recorded a net inflow of $639 million last week, a remarkable turnaround from the previous week’s largest-ever net outflow of $798 million.

This dramatic shift indicates renewed confidence among institutional players, highlighting the growing appetite for Ethereum exposure.

The bullish momentum has carried into the current week, with inflows already hitting $360 million. Such trends confirm that major investors are positioning themselves favorably, potentially setting the stage for ETH to reach new highs as the altcoin season gathers steam.

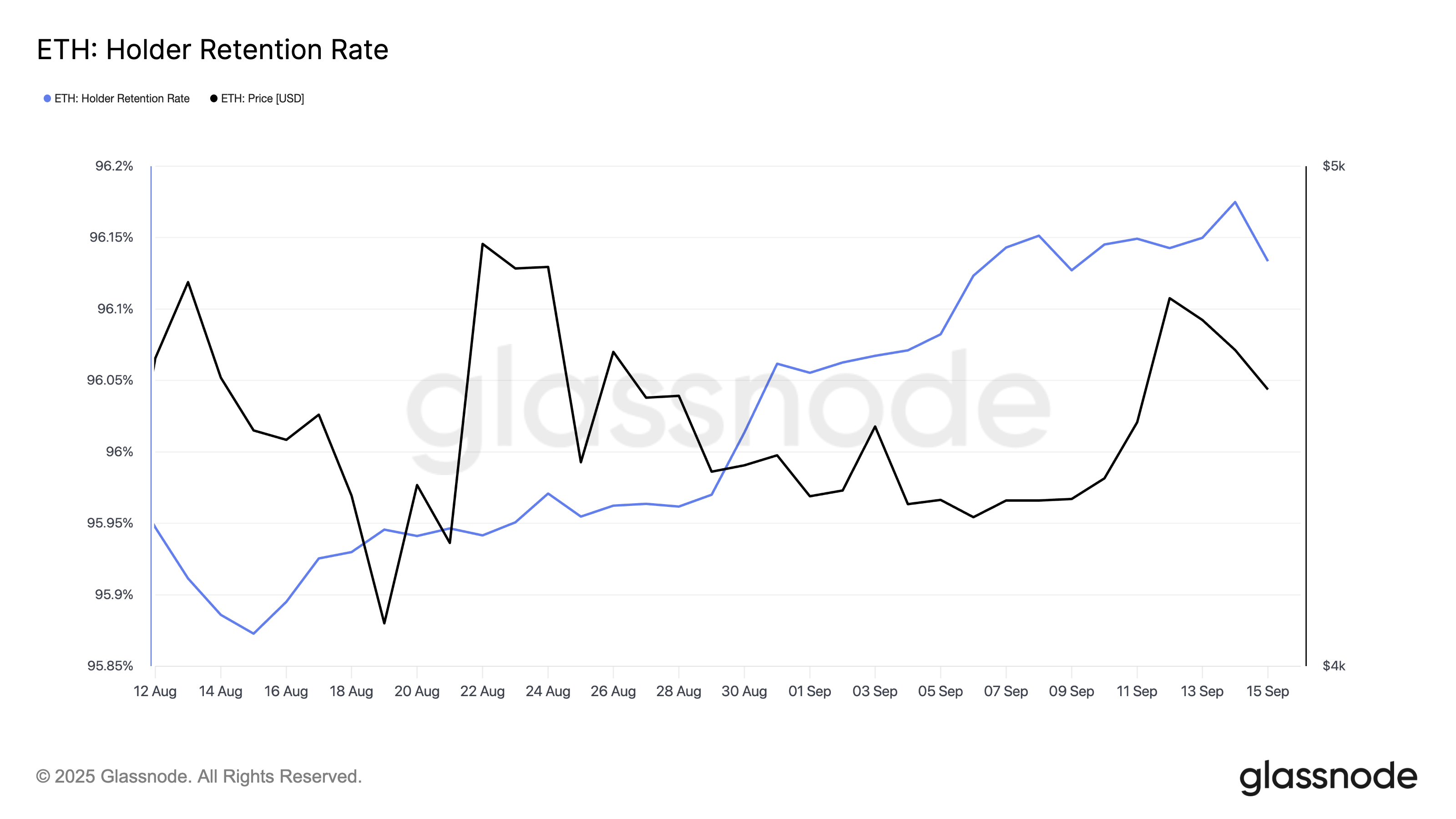

Even amidst the recent volatility, ETH holders are displaying strong conviction, as evidenced by the rising Holder Retention Rate, which currently sits at 96.13%. This metric measures the percentage of addresses maintaining a balance of ETH over consecutive 30-day periods. A rising retention rate indicates that investors are opting to hold onto their assets rather than liquidate, despite short-term fluctuations.

This behavior can be seen as a reflection of growing faith in Ethereum’s long-term potential, which may facilitate a quicker ascent towards $5,000 as the market settles deeper into this altcoin season.

$4,957 Breakout Could Ignite Rally to $5,000

For Ethereum to break the downtrend it is currently experiencing, a sustained uptick in institutional inflows coupled with steadfast holding behavior among investors is essential.

Such momentum might propel the price toward the critical $4,957 resistance level. A successful breakout above this barrier could very well pave the way for a rally to touch the $5,000 milestone.

Conversely, should market sentiment weaken further, ETH risks the possibility of cascading downside, potentially revisiting support levels around $4,211.